This Item Ships For Free!

Sd v wayfair sales

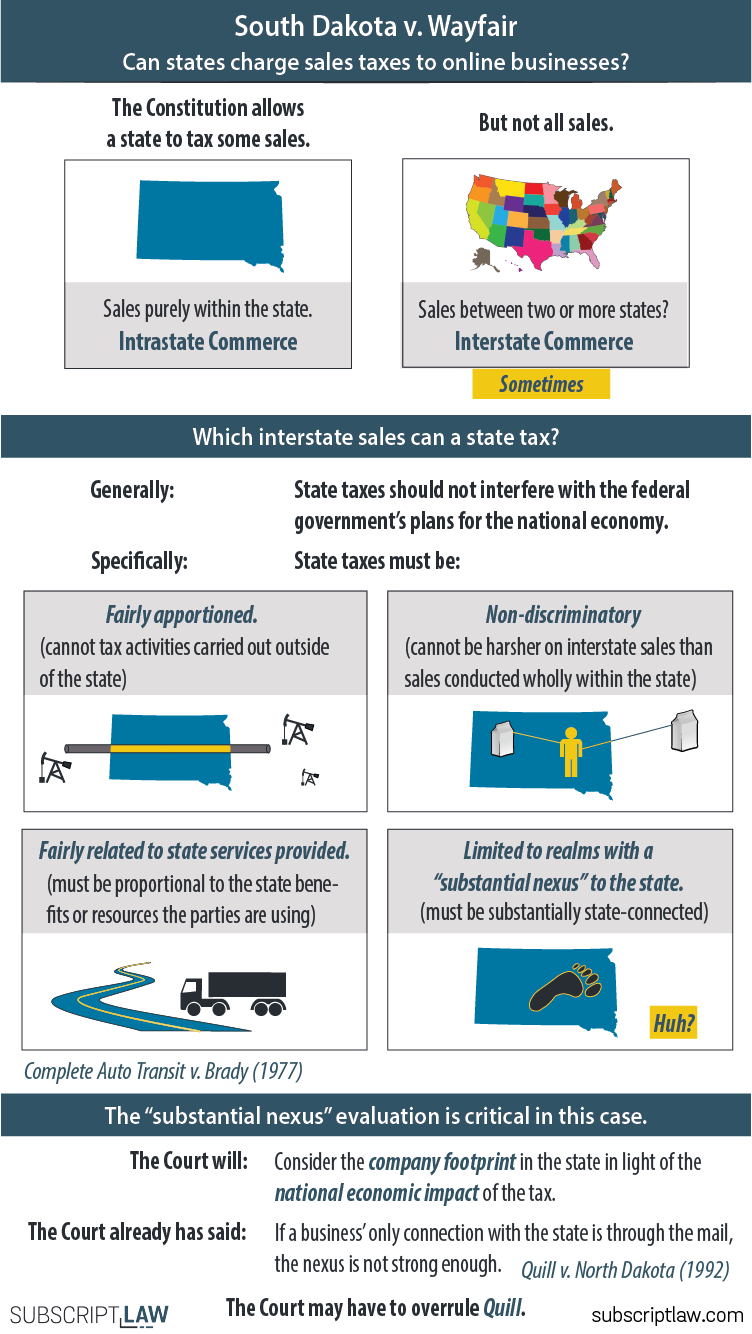

Sd v wayfair sales, South Dakota v. Wayfair Inc. What Does the Supreme Court Ruling Mean for Ecommerce Sales and Orders sales

4.84

Sd v wayfair sales

Best useBest Use Learn More

All AroundAll Around

Max CushionMax Cushion

SurfaceSurface Learn More

Roads & PavementRoads & Pavement

StabilityStability Learn More

Neutral

Stable

CushioningCushioning Learn More

Barefoot

Minimal

Low

Medium

High

Maximal

Product Details:

Product code: Sd v wayfair salesThree Years of South Dakota v. Wayfair Sales Tax Institute sales, South Dakota v. Wayfair Argument April 17 2018 Subscript Law sales, South Dakota v. Wayfair Inc. Key takeaways for online sellers sales, SCOTUS South Dakota v Wayfair sales, South Dakota v. Wayfair Decided June 21 2018 Subscript Law sales, South Dakota v. Wayfair Update for Manufacturers Rootstock Software sales, South Dakota v. Wayfair Inc. SCOTUSbrief sales, Growing Number of State Sales Tax Jurisdictions Makes South Dakota v. Wayfair That Much More Imperative sales, South Dakota v. Wayfair Impact to IT sales, Online Sales Tax The Impact of The Supreme Court s Ruling BigCommerce sales, South Dakota v. Wayfair Inc. 138 S. Ct. 2080 2018 Case Brief Summary Quimbee sales, South Dakota v. Wayfair is Decided What Does It Mean for You Sales Tax Institute sales, South Dakota v. Wayfair Insights and Analysis SALT Shaker sales, SD v Wayfair The Decision Day 1 Analysis with Diane Yetter sales, Wayfair V South Dakota 2024 www.alhudapk sales, Opinion analysis Court expands states ability to require internet retailers to collect sales tax SCOTUSblog sales, 85KB 2001 null null null 12 21 6 6 1 2003 null vNiwnPiBLmrbrM sales, Sd V Wayfair 2024 jacksonvillechristianacademy sales, What South Dakota v. Wayfair Inc. Means for Consumers Retailers and State Governments sales, FICPA on X The latest issue of FloridaCPAToday magazine features David Brennan s deep dive into South Dakota v. Wayfair the Supreme Court decision that changed the rules for online retailers and tax sales, South Dakota v. Wayfair TaxJar sales, One year out Wayfair and SST converge to shape remote sales tax legislation BCS ProSoft sales, South Dakota v. Wayfair Tax Glossary sales, The United States Supreme Court and the Wayfair Decision Update CohnReznick sales, 5 years later Jackley recognizes historic South Dakota v. Wayfair US Supreme Court Decision DRGNews sales, Wayfair Decision 2024 www.alhudapk sales, MTC Files Brief in Support of South Dakota s Petition in Wayfair Case MTC sales, The South Dakota v. Wayfair Decision and Your Ecommerce Business sales, Sales Tax Nexus And Its Impact on eCommerce Store Owners sales, Economic Nexus and South Dakota v. Wayfair Inc. Avalara sales, What the South Dakota v. Wayfair Case Means for your E Commerce Business Seller Accountant Ecommerce Accountants sales, South Dakota v. Wayfair Inc. What Does the Supreme Court Ruling Mean for Ecommerce Sales and Orders sales, Five years after the Wayfair ruling states reliance on the sales tax grows Route Fifty sales, South Dakota v. Wayfair State reaches settlement will collect online sales tax from retailers sales, The Wayfair Series SimekScott sales.

- Increased inherent stability

- Smooth transitions

- All day comfort

Model Number: SKU#7571431